Best Energy Stocks for Day Trading in March 2026

Monster Energy, Lo-Carb Monster, Low Carb Energy Drink, 16 Ounce (Pack of 15)

-

POWERFUL ENERGY BOOST: 140MG CAFFEINE DELIVERS BIG ENERGY WITHOUT THE CARBS!

-

SMOOTH FLAVOR EXPERIENCE: ENJOY A REFRESHING TASTE WITH ONLY 30 CALORIES!

-

CONVENIENT 15-PACK: STAY ENERGIZED-STOCK UP WITH OUR VALUE 15-PACK OPTION!

Monster Energy Ultra Black, Sugar Free Energy Drink, 16 Ounce (Pack of 15)

-

INDULGE GUILT-FREE: ENJOY FULL FLAVOR WITH ZERO SUGAR AND JUST 10 CALORIES!

-

LIMITED TIME CHERRY FLAVOR: TASTE THE CRISP BLACK CHERRY, PERFECT FOR SUMMER!

-

STOCK UP & SAVE: GET YOUR REFRESHMENT IN A CONVENIENT 15-PACK!

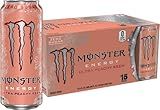

Monster Energy Ultra Peachy Keen, Sugar Free Energy Drink, 16 oz (Pack of 15)

- ZERO SUGAR, FULL FLAVOR: ENJOY ALL THE TASTE WITHOUT THE GUILT!

- REFRESHING PEACHY TASTE: SIP INTO SUMMER VIBES ALL YEAR ROUND!

- CONVENIENT 15-PACK: STOCK UP ON YOUR FAVORITE ENERGY BOOST NOW!

Monster Energy Rehab Tea + Lemonade + Energy, Energy Iced Tea, Energy Drink 15.5 Ounce (Pack of 15)

-

REVITALIZE WITH 160MG CAFFEINE AND 25 CALORIES PER CAN!

-

NON-CARBONATED DRINK PACKED WITH ELECTROLYTES AND BOTANICALS.

-

CONVENIENT 15 PACK TO KEEP YOU REFRESHED AND ENERGIZED!

Monster Energy Ultra Vice Guava, Sugar Free Energy Drink, 16 Ounce (Pack of 15)

- FULL FLAVOR, ZERO SUGAR: ENJOY MONSTER ULTRA VICE GUAVA GUILT-FREE!

- REFRESHING GUAVA TASTE PERFECT FOR ANY OCCASION-STAY ENERGIZED!

- CONVENIENT 15-PACK: STOCK UP ON YOUR FAVORITE LIGHT-TASTING ENERGY!

5-hour ENERGY Shots Extra Strength, Berry Flavor, 30 Count, 1.93 Fl Oz, Sugar Free, Zero Calories, Amino Acids and Essential B Vitamins, Dietary Supplement, Feel Alert and Energized, 230 mg Caffeine

- ZERO SUGAR, ZERO CALORIES-ENERGY WITHOUT THE CRASH OR GUILT!

- 230MG CAFFEINE DELIVERS FAST ENERGY-FASTER THAN YOUR MORNING COFFEE.

- PORTABLE SHOTS FIT ANYWHERE-PERFECT FOR ON-THE-GO ENERGY NEEDS!

5-hour ENERGY Extra Strength Energy Shot, Grape Flavor, 30 Count, 1.93 oz., Zero Calories & Sugar-Free 230 mg Caffeinated Energy Shot, Amino Acids & B Vitamins, Dietary Supplements

- ZERO SUGAR & CALORIES: ENERGIZE WITHOUT THE GUILT OR CRASH!

- QUICK ENERGY BOOST: 230MG CAFFEINE FOR INSTANT ALERTNESS!

- PORTABLE POWER: EASY TO CARRY FOR ENERGY ON THE GO!

When looking to find energy stocks for day trading, it is important to first conduct thorough research on the energy sector as a whole. This can involve studying market trends, industry news, and economic indicators that may impact energy stocks.

One effective strategy is to focus on the most actively traded energy stocks, as these are more likely to have volatile price movements that can be capitalized on in day trading. It can also be helpful to look for stocks with a high beta, as this indicates that the stock is more volatile compared to the overall market.

In addition, paying attention to company earnings reports and announcements can provide valuable insights into the financial health and future prospects of energy stocks. Finally, utilizing technical analysis tools and indicators, such as moving averages and relative strength index (RSI), can help identify potential entry and exit points for day trading energy stocks.

What is the best time of day to trade energy stocks?

The best time of day to trade energy stocks can vary depending on the specific stock, market conditions, and personal trading strategy. However, many traders believe that the first hour of trading, known as the opening bell, and the last hour of trading, known as the closing bell, tend to be the most volatile and potentially profitable times to trade energy stocks.

During the opening bell, there is typically higher trading volume and more price movement as traders react to overnight news and market events. This can create opportunities for quick profits, but also involves higher risk due to increased volatility.

During the closing bell, traders often re-evaluate their positions and adjust their portfolios before the market closes. This can lead to significant price swings and opportunities for profit.

Ultimately, the best time to trade energy stocks depends on your personal trading style, risk tolerance, and market conditions. It is important to do thorough research and analysis before making any trading decisions.

How to evaluate the fundamentals of energy companies for day trading?

When evaluating the fundamentals of energy companies for day trading, it is important to consider the following factors:

- Company financials: Analyze the company's financial statements, including revenue, earnings, and cash flow. Look for companies with strong financials and stable revenue growth.

- Industry trends: Stay informed about the latest developments in the energy sector, including changes in regulations, technological advances, and shifts in consumer behavior.

- Competitive landscape: Evaluate the company's market position relative to its competitors. Look for companies that have a competitive advantage, such as lower production costs or innovative technology.

- Management team: Assess the company's leadership team and their track record of success. Look for a strong management team with a clear vision for the company's future.

- Valuation metrics: Consider the company's valuation metrics, such as price-to-earnings ratio, price-to-sales ratio, and price-to-book ratio. Compare these metrics to industry averages to determine if the stock is undervalued or overvalued.

- News and events: Monitor news and events that could impact the company's stock price, such as earnings reports, regulatory announcements, and geopolitical developments.

By considering these factors, day traders can make informed decisions about which energy companies to trade based on their fundamentals. It is also important to use technical analysis and risk management strategies to maximize profitability and minimize losses.

What is the importance of liquidity in day trading energy stocks?

Liquidity is crucial in day trading energy stocks for several reasons:

- Ease of buying and selling: High liquidity means that there is a large number of buyers and sellers in the market, making it easier for traders to enter and exit positions quickly without significant price fluctuations.

- Lower transaction costs: With high liquidity, bid-ask spreads tend to be tighter, which means that traders can buy and sell stocks at prices closer to the market price, reducing transaction costs.

- Price stability: High liquidity leads to price stability, as there are more participants in the market and large trades are less likely to have a significant impact on the stock price.

- Risk management: Liquidity allows traders to easily manage their positions and exit trades in case the market moves against them, reducing the risk of losses.

Overall, liquidity plays a crucial role in day trading energy stocks by providing traders with the ability to easily enter and exit positions, manage risks, and reduce transaction costs.

How to time your entries and exits when trading energy stocks?

Timing your entries and exits when trading energy stocks can be challenging, but there are a few key strategies you can use to help maximize your profits and minimize your losses:

- Monitor market trends: Stay informed about the overall market conditions and energy sector trends. Pay attention to factors such as oil prices, supply and demand dynamics, geopolitical events, and regulatory changes that can impact energy stocks.

- Use technical analysis: Analyze price charts and technical indicators to identify potential entry and exit points. Look for patterns, trends, and support/resistance levels to help guide your decision-making process.

- Set stop-loss orders: Establish stop-loss orders to limit your potential losses. This allows you to automatically sell a stock if it reaches a certain price, helping to protect your investment.

- Consider fundamental analysis: Evaluate the financial performance and growth prospects of energy companies before making trading decisions. Look at factors such as earnings reports, revenue growth, profit margins, and debt levels to determine the intrinsic value of a stock.

- Be patient and disciplined: Avoid emotional decision-making and stick to your trading plan. Wait for clear signals to enter or exit a trade, and be prepared to cut your losses if a trade is not working out as expected.

- Diversify your portfolio: Spread your investments across multiple energy stocks to reduce risk and increase potential returns. This can help offset losses from underperforming stocks and capitalize on opportunities in the market.

- Stay informed: Continuously research and stay informed about the latest developments in the energy sector. Attend industry conferences, read financial news sources, and follow expert analysts to gain insights into potential investment opportunities.

By following these strategies and staying disciplined in your trading approach, you can improve your chances of successfully timing your entries and exits when trading energy stocks.

What is the difference between day trading and swing trading energy stocks?

Day trading and swing trading are both short-term trading strategies that involve buying and selling stocks within a relatively short period of time, usually within a few days or weeks. The main difference between the two lies in the timeframe in which the trades are executed and the frequency of trades.

Day trading involves buying and selling stocks within the same trading day, with the goal of making quick profits from short-term price fluctuations. Day traders typically focus on short-term price movements and use technical analysis and chart patterns to make their trading decisions. Day trading is often fast-paced and requires a high level of attention and discipline.

Swing trading, on the other hand, involves holding stocks for a slightly longer period of time, usually a few days to a few weeks. Swing traders aim to capitalize on short- to medium-term price trends and typically use a combination of technical and fundamental analysis to identify potential trading opportunities. Swing trading is less time-sensitive than day trading, allowing traders to take a more relaxed approach to trading.

When it comes to trading energy stocks specifically, the same principles of day trading and swing trading apply. However, energy stocks can be more volatile and sensitive to macroeconomic factors, geopolitical events, and changes in commodity prices. Day trading energy stocks may be more risky due to the high volatility and rapid price fluctuations in the energy sector, while swing trading energy stocks may offer more stability and potentially higher returns over a longer time horizon. Ultimately, the choice between day trading and swing trading energy stocks will depend on your trading style, risk tolerance, and investment goals.

How to adjust your approach based on market conditions when day trading energy stocks?

When day trading energy stocks, it's important to constantly monitor and adjust your approach based on market conditions. Here are some strategies for adjusting your approach:

- Keep an eye on the overall market trends: Pay attention to the overall market trends and how they are impacting energy stocks. If the market is experiencing volatility or major fluctuations, it may be best to adopt a more conservative approach and avoid high-risk trades.

- Stay informed on geopolitical events: Geopolitical events can have a significant impact on the energy sector, so it's important to stay informed on political developments that could affect energy prices. Adjust your trading strategy accordingly to account for any potential risks or opportunities.

- Monitor supply and demand dynamics: Keep track of supply and demand dynamics in the energy market, as they can have a direct impact on stock prices. If there is a significant increase in supply or a decrease in demand, it may be wise to adjust your trading strategy to minimize risk.

- Utilize technical analysis: Technical analysis can help you identify trends and patterns in stock prices, which can be useful for making informed trading decisions. Use technical indicators such as moving averages, RSI, and MACD to analyze price movements and adjust your trading strategy accordingly.

- Be flexible and adaptable: Market conditions can change rapidly, so it's important to be flexible and adaptable in your trading approach. Be prepared to quickly adjust your strategy if necessary to take advantage of new opportunities or mitigate potential risks.

Overall, adjusting your approach based on market conditions when day trading energy stocks requires a combination of research, analysis, and flexibility. By staying informed and making strategic adjustments, you can optimize your trading strategy and increase your chances of success in the energy market.