ArticleGift

-

4 min readA mud mask is a skincare product that is applied to the face and left to dry before being washed off. It is typically made from various clays, such as bentonite, kaolin, or French green clay, combined with other ingredients like botanical extracts, essential oils, or vitamins.When applied to the skin, a mud mask serves several purposes:Deep Cleansing: Mud masks have excellent purifying properties that draw out impurities, toxins, and excess oil from the skin.

4 min readA mud mask is a skincare product that is applied to the face and left to dry before being washed off. It is typically made from various clays, such as bentonite, kaolin, or French green clay, combined with other ingredients like botanical extracts, essential oils, or vitamins.When applied to the skin, a mud mask serves several purposes:Deep Cleansing: Mud masks have excellent purifying properties that draw out impurities, toxins, and excess oil from the skin.

-

6 min readCooking lobster claws from frozen is a simple process that you can do right in your own kitchen. Here's a step-by-step guide on how to do it:Thaw the frozen lobster claws: Place the frozen lobster claws in a sealed plastic bag and submerge them in cold water. Let them sit for about 30 minutes to thaw. You can also thaw them overnight in the refrigerator for a more controlled thawing process.

6 min readCooking lobster claws from frozen is a simple process that you can do right in your own kitchen. Here's a step-by-step guide on how to do it:Thaw the frozen lobster claws: Place the frozen lobster claws in a sealed plastic bag and submerge them in cold water. Let them sit for about 30 minutes to thaw. You can also thaw them overnight in the refrigerator for a more controlled thawing process.

-

2 min readMeat claws, also known as meat shredding claws or bear claws, are a pair of kitchen tools designed to handle and shred cooked meat, typically large cuts of meat like pork, beef, or poultry. They are called "meat claws" because they often have a design that resembles the sharp, curved claws of a bear.

2 min readMeat claws, also known as meat shredding claws or bear claws, are a pair of kitchen tools designed to handle and shred cooked meat, typically large cuts of meat like pork, beef, or poultry. They are called "meat claws" because they often have a design that resembles the sharp, curved claws of a bear.

-

If you are in to seafood, a good moules marinières is a real treat. With a little bit of effort, our moules marinières recipe will satisfy anyone with a love of shell fish.

If you are in to seafood, a good moules marinières is a real treat. With a little bit of effort, our moules marinières recipe will satisfy anyone with a love of shell fish.

-

The KitchenAid ksm150ps artisan 5 qt stand mixer gives you everything you want in a mixer – a powerful motor, big stainless-steel bowl and solid results. It excels in everything you want a mixer to do in the kitchen.

The KitchenAid ksm150ps artisan 5 qt stand mixer gives you everything you want in a mixer – a powerful motor, big stainless-steel bowl and solid results. It excels in everything you want a mixer to do in the kitchen.

-

5 min readFor fine and thin hair, a curling iron with a smaller barrel diameter is recommended. Smaller barrel sizes create tighter curls, which can add volume and texture to fine hair without weighing it down.

5 min readFor fine and thin hair, a curling iron with a smaller barrel diameter is recommended. Smaller barrel sizes create tighter curls, which can add volume and texture to fine hair without weighing it down.

-

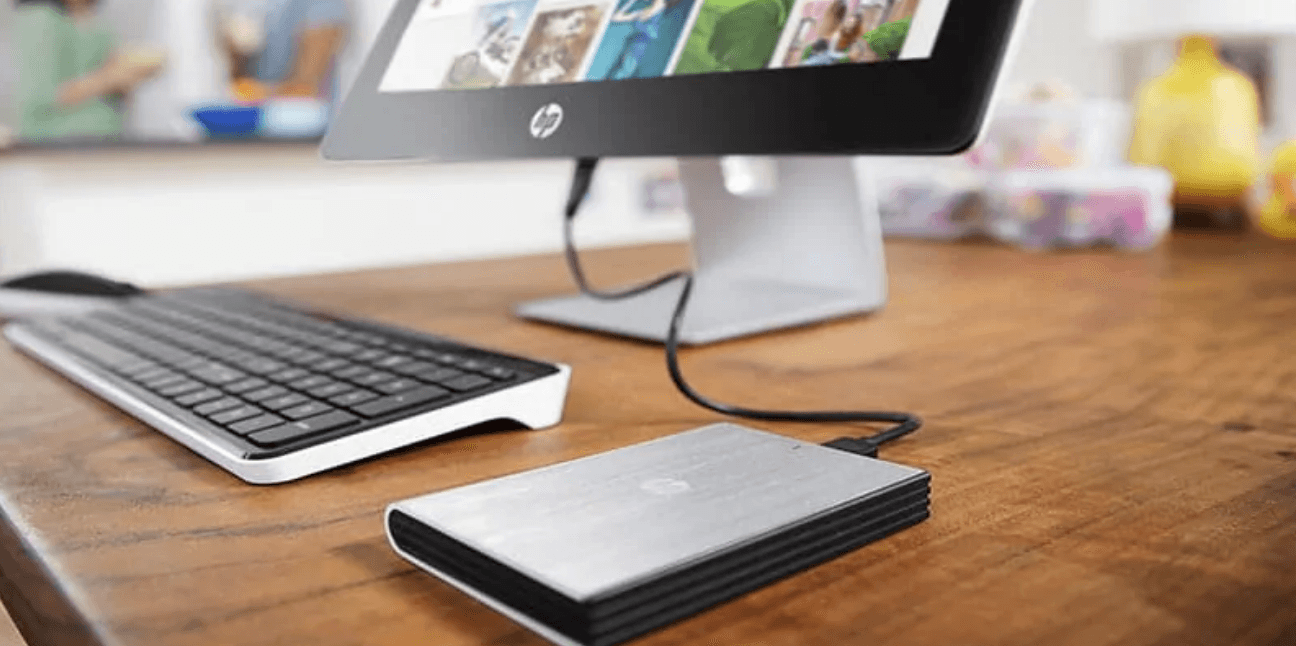

In layman language, an external drive, which gets sometimes referred to as solid-state drive or merely the hard disk(HDD), is the computer storage connected to your computer via an external cable from outside, unlike an internal drive is inside your computer. There are various types of external hard drives available, and some of them usually can draw power over the data cable in use. Other external hard drives require you to have an AC connected to the wall for the hard drive to draw its power. An external hard drive is usually portable devices that add extra storage space to your machine when plugged into your computer.

In layman language, an external drive, which gets sometimes referred to as solid-state drive or merely the hard disk(HDD), is the computer storage connected to your computer via an external cable from outside, unlike an internal drive is inside your computer. There are various types of external hard drives available, and some of them usually can draw power over the data cable in use. Other external hard drives require you to have an AC connected to the wall for the hard drive to draw its power. An external hard drive is usually portable devices that add extra storage space to your machine when plugged into your computer.

-

A food dehydrator is used to dry a wide range of fruits and vegetables. These convenient kitchen appliances are becoming very popular. This is because they are easy to use, cheap to run and offer a healthy alternative to shop-bought goods.

A food dehydrator is used to dry a wide range of fruits and vegetables. These convenient kitchen appliances are becoming very popular. This is because they are easy to use, cheap to run and offer a healthy alternative to shop-bought goods.

-

2 min readSharlotka is a traditional Russian apple cake that is typically made with wheat flour. However, you can easily adapt the recipe to be gluten-free by using almond flour as a substitute.

2 min readSharlotka is a traditional Russian apple cake that is typically made with wheat flour. However, you can easily adapt the recipe to be gluten-free by using almond flour as a substitute.

-

Beef Bourguignon is widely loved classic dish. It is one of those meals you can take your time cooking while sipping on a glass of wine. This is the best beef bourguignon recipe we have tried at Clubnomnmnom.

Beef Bourguignon is widely loved classic dish. It is one of those meals you can take your time cooking while sipping on a glass of wine. This is the best beef bourguignon recipe we have tried at Clubnomnmnom.

-

One of the most popular dishes you will find in the French Alps is Tartiflette. From the the traditional recipe to a trendy deconstructed versions, tartiflette is served in pretty much every restaurant in the alps. You can even get tartiflette pizzas!

One of the most popular dishes you will find in the French Alps is Tartiflette. From the the traditional recipe to a trendy deconstructed versions, tartiflette is served in pretty much every restaurant in the alps. You can even get tartiflette pizzas!