Best Moving Average Strategies for Day Traders in February 2026

Anaeat Stainless Steel Spider Skimmer, Set of 3 Professional Kitchen Pasta Strainer Spoon with Long Handle - Asian Strainer Ladle Wire Skimmer Spoons for Cooking and Frying (4.5"+5.3"+6.1")

-

DURABLE STAINLESS STEEL CONSTRUCTION FOR LONG-TERM USE!

-

ERGONOMIC LONG HANDLE PREVENTS HOT SPLASHES WHILE COOKING!

-

VERSATILE SKIMMER: PERFECT FOR FRYING, STRAINING, AND MORE!

FJCTER Screen Roller Tool Set with Spline Removal Hook, 2pcs Window Screen Roller for Screen Installation Repair Replacement, Durable Screen Spline Tool Kit for Window Sliding Door Patio RV

-

EFFORTLESS REPAIRS: DUAL-HEAD TOOL SET MAKES SCREEN REPAIRS A BREEZE!

-

PRECISION ENGINEERING: SMOOTH INSTALLATION WITH PROFESSIONAL RESULTS EVERY TIME.

-

ERGONOMIC COMFORT: DESIGNED FOR EASY HANDLING, REDUCING FATIGUE ON LONG TASKS.

Anaeat Stainless Steel Fat Skimmer Spoon - Set of 3 Professional Kitchen Fine Mesh Food Strainer and Hot Pot Skimmer with Long Handle for Skimming, Cooking, Frying, Grease, Gravy and Foam (3"+4"+4.7")

- PREMIUM STAINLESS STEEL: DURABLE & LONG-LASTING FOR EVERYDAY USE.

- VERSATILE DESIGN: PERFECT FOR SKIMMING, STRAINING, AND FILTERING.

- HEAT-RESISTANT HANDLE: SAFE & ERGONOMIC FOR EASY COOKING.

Screen Roller Tool - Rolling Tool for Installing Door & Window Screens & Repair - Spline Roller with Wood Handle & Steel Bearing Wheel - Professional Rolling Tool - Double Ended Hand Spline Roller

-

SIMPLIFIES SCREEN INSTALLATION FOR DURABLE, PROFESSIONAL RESULTS.

-

2-IN-1 DESIGN, QUICKLY ADAPTS TO ANY SCREEN PROJECT NEEDS.

-

DURABLE MATERIALS AND ERGONOMIC HANDLE ENSURE COMFORT AND PRECISION.

Prime-Line MP7503 Screen Rolling Tool with Nylon Wheels, For 0.115 In. to 0.165 In. Spline (Single Pack)

- DURABLE PLASTIC HANDLE ENSURES LONG-LASTING PERFORMANCE.

- VERSATILE SPLINE SIZE RANGE: FITS 0.115 - 0.165 ROLLERS.

- NYLON ROLLERS PROVIDE SMOOTH, EFFICIENT OPERATION EVERY USE.

Anaeat Stainless Steel Spider Strainer Skimmer - Solid Kitchen Strainer Ladle with Long Handle for Cooking and Frying, Reinforced Double Coil Slotted Spoons for Pasta, Noodle, Spaghetti (7 Inch)

- DURABLE DOUBLE-COIL DESIGN HANDLES HEAVIER FOOD WITH EASE.

- PREMIUM STAINLESS STEEL CONSTRUCTION ENSURES LONG-LASTING USE.

- VERSATILE SKIMMER PERFECT FOR FRYING, STRAINING, AND EASY CLEANING.

Prime-Line P 7505 Screen Rolling Tool – A Must Have Tool for Installing Window and Door Screens – Spline Roller with Wood Handle and Steel Wheels – Durable and Easy to Use (Single Pack)

-

ESSENTIAL TOOL FOR EASY WINDOW & DOOR SCREEN REPLACEMENTS!

-

DURABLE DESIGN: WOODEN HANDLE & STEEL ROLLERS FOR LONG-LASTING USE!

-

VERSATILE: WORKS WITH MOST SCREENING MATERIALS AND SPLINE SIZES!

Screen Repair Kit/Tool, King&Charles Screen Roller Tool, Steel Roller with Bear, 32 ft Spline, Removal Hook, 3 in 1 Window Repair Kit, for Installing Door Window Mesh.

-

EFFORTLESS REPAIRS: COMPLETE KIT FOR FAST, EFFICIENT SCREEN REPLACEMENTS.

-

DURABLE & RELIABLE: HIGH-STRENGTH SPLINE AND BEARING ROLLER FOR LONGEVITY.

-

VERSATILE USE: SUITABLE FOR VARIOUS SCREENS AROUND THE HOME AND MORE!

Screen Tool for Window Screen Replacement - Two Spline Roller (Steel and Nylon Bearing Roller), Spline Removal Hook, Two Sizes Screen Spline, Utility Knife, Tape Measure, Tooltriz

-

COMPLETE 7-IN-1 TOOLKIT MAKES SCREEN REPAIR SIMPLE AND EFFICIENT.

-

TWO ROLLER SETS ENSURE SMOOTH INSTALLATION FOR EVERY SCREEN PROJECT.

-

DURABLE SPLINE SUITS MOST WINDOWS, SAVING YOU TIME AND MONEY!

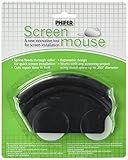

SCREEN MOUSE ROLLER TOOL by PHIFER MfrPartNo 3027440

- EFFORTLESS INSTALLATION WITH INNOVATIVE ROLLER TOOL DESIGN.

- VERSATILE: FITS ANY SCREENING PROJECT USING .250” ROUND SPLINE.

- STREAMLINED SPLINE FEEDING FOR QUICK, EASY SETUP EVERY TIME.

Moving averages can be a very useful tool for day trading, as they help traders identify trends and potential entry and exit points. When using moving averages in a stock screener for day trading, it's important to pay attention to two key types of moving averages: the simple moving average (SMA) and the exponential moving average (EMA).

The simple moving average is calculated by taking the average price of a stock over a certain period of time, such as 50 days or 200 days. This can help traders identify trends over a longer period of time and signal potential buying or selling opportunities.

The exponential moving average, on the other hand, gives more weight to more recent prices, making it more responsive to short-term price changes. This can be useful for day traders looking to capitalize on short-term trends and momentum in the market.

When using moving averages in a stock screener for day trading, traders can look for crossovers between different moving averages, such as the 5-day EMA crossing above the 20-day SMA. This can signal a potential buying opportunity. Conversely, a crossover where the shorter-term moving average crosses below the longer-term moving average can signal a potential selling opportunity.

Overall, moving averages can be a valuable tool for day traders looking to identify trends and potential entry and exit points in the market. By using moving averages effectively in a stock screener, traders can increase their chances of success in the fast-paced world of day trading.

How to adjust moving average parameters based on stock volatility?

One way to adjust moving average parameters based on stock volatility is to use a volatility-based indicator, such as the Average True Range (ATR), to calculate the optimal parameters for the moving average.

Here's a general approach to adjusting moving average parameters based on stock volatility:

- Calculate the Average True Range (ATR) for the stock. ATR measures the average daily trading range of a stock, taking into account gaps and limit moves.

- Use the ATR value to determine the optimal parameters for the moving average. For example, you can use a multiple of the ATR value to determine the optimal period for the moving average. For instance, if the ATR value is 10 and you want to use a multiple of 2, the optimal period for the moving average would be 20.

- Test different combinations of moving average parameters with different multiples of the ATR value to see which one works best for the stock. Opt for a combination that provides the best results in terms of trend identification and signal accuracy.

- Monitor the stock's volatility over time and adjust the moving average parameters accordingly. Stocks with higher volatility may require shorter moving average periods, while stocks with lower volatility may benefit from longer periods.

By adjusting moving average parameters based on stock volatility, you can potentially improve the accuracy and effectiveness of your trading strategy. It's important to continue monitoring the stock's volatility and adjusting the parameters as needed to ensure that your moving average remains relevant and responsive to market conditions.

What is the impact of moving averages on trading psychology?

Moving averages can have a significant impact on trading psychology for traders. Here are a few key ways in which moving averages can affect psychology:

- Trend Identification: Moving averages can help traders identify trends in the market. This can lead to feelings of reassurance and confidence in their trading decisions when they see the moving average line confirming the direction of the trend.

- Confirmation Bias: Moving averages can also create a sense of confirmation bias, where traders may be more likely to see signals that align with the moving average line as being more accurate or valid. This can lead to overconfidence in trading decisions based on moving averages.

- Emotional Stability: Moving averages can help provide a sense of stability and structure to traders, which can reduce emotional reactions to short-term fluctuations in price. This can help traders maintain a more disciplined and rational approach to trading.

- Decision-making: Moving averages can help traders make more informed and objective decisions based on trends in the market. This can lead to a more systematic and disciplined approach to trading, which can help improve trading psychology overall.

Overall, the impact of moving averages on trading psychology can be positive in terms of helping traders identify trends, reduce emotional reactions, and make more informed decisions. However, it is important for traders to be aware of potential biases and to use moving averages in conjunction with other technical indicators and analysis techniques to avoid making decisions solely based on moving averages.

How to use moving averages as dynamic support/resistance levels?

Moving averages can be used as dynamic support and resistance levels by identifying key moving averages that have historically acted as levels of support or resistance in the past. Here's how you can use moving averages as dynamic support/resistance levels:

- Identify key moving averages: Start by identifying key moving averages that are commonly used in trading, such as the 50-day moving average, 100-day moving average, and 200-day moving average. These moving averages are often watched by traders and can act as significant levels of support and resistance.

- Monitor the price action: Keep an eye on how the price interacts with these moving averages over time. If the price consistently bounces off a certain moving average and continues to trend higher, then that moving average can be considered a level of support. Conversely, if the price struggles to break above a certain moving average and continues to trend lower, then that moving average can be considered a level of resistance.

- Use moving averages in your trading strategy: Incorporate these key moving averages into your trading strategy by setting stop-loss orders just below support levels and take-profit orders just below resistance levels. This can help you manage your risk and maximize your profits based on the dynamic support and resistance provided by moving averages.

- Combine with other technical indicators: To increase the accuracy of your trading decisions, consider combining moving averages with other technical indicators such as trend lines, Fibonacci retracement levels, or momentum oscillators. This can help confirm potential support and resistance levels identified by moving averages and provide additional confirmation signals for your trades.

Overall, using moving averages as dynamic support and resistance levels can help you identify key levels in the market where price could potentially reverse or continue its trend, allowing you to make more informed trading decisions.